The

observations made in this blog refer to the following illustrations:-

Gross

State Domestic Product (GSDP) by Industry of Origin (at 2004-05 Prices) for a

set of selected states given in the blog posts titled:-

In

the above mentioned blog posts an attempt has been made to choose good mix of

states (few relatively developed states and few not so developed states) for

illustrating changes to GSDP from 2004-05 to 2013-2014 (P). The data for

2013-14 are given as projected values in data source. Changing composition of

domestic produce may be one of the ways to develop an initial understand on any

economy.

One

way to look at the structure of an economy is to compare the shares of its

three main sectors – agriculture, industry and services – in the country’s

total output and employment. Initially agriculture in developing economies is

the most important sector. But as the income per capita rises, agriculture

loses its primacy, giving way first to rise in the industrial sector, then to

rise in service sector. The two consecutive shifts are called industrialization

and post industrialization. All growing economies are likely to go through these

stages, which can be explained by structural changes in consumer demand and in

relative labour productivity of the three main economic sectors – Growth

of the Service Sector, World Bank

A. Observations on GSDP Data:

1. Changes

in GSDP of the states during the period 2004 to 2014 suggest that increase in

production of Industry sector and Services sector have outperformed increase in

production of Agriculture and Allied sector. Thus, percent

contribution on Agriculture and Allied sector to the gross domestic production

of the states has reduced over the years. While, this has been a general trend

across the states, there are a couple of exceptions. GSDP of Jharkhan (JK) has

contribution from Agriculture and Allied sector as 15% in the year 2014, which is

exactly same in terms of percentage contribution as was in the year 2004-05.

GSDP of Madhya Pradesh (MP) shows 1% increase in contribution from Agriculture

and Allied sector in the year 2014 as compared to that of the year 2004-05. In

MP, a surge in agricultural produce in last three years accounts for the

marginal increment in contribution to GSDP. Fisher-Clark Theory of stages of

development suggest that as industrialization takes place in an economy, the

share of primary or agriculture sector in total output and employment gradually

diminishes, while that of the secondary or manufacturing sector increases. This

popular theory has been re-interpreted and extended by many economists to

explain empirical observations related to increase in contribution from service

sector during post-industrialization phase in advanced economies and also in

under developed economies.

2. The

process of structural change in recent decades has turned developed economies

into services economies.... Traditional ideas associate services growth with

both their lower apparent relative productivity and higher levels of income.

Although there is some validity to these theories, current evidences and recent

data reveal other underlying elements that act as driving forces on services:

changes in production factor, changes in productive systems, changes in market

and changes in institutional system.

These changes are related to factors such as information and

communications society, globalization and demographical and territorial

changes. Among these factors some stand out: integration between goods and

services, which has increased the intermediate demand for business services,

the inter-relation between new technologies, innovation and services; the

importance of human capital and qualifications (particularly in advanced

services) and specialization; the role of international trade and investment;

and finally, though it is regulations and institutional changes, the role of

the state in economy. Moreover, the influence of statistical factors is, to a

certain extent present in the advances experienced by services as a sector.

Large enterprises traditionally considered manufacturers became tertiary

companies, when their production of services exceeded a certain threshold. (Growth

and Productivity in Services Sector: The State of Art, 2010 Working Paper,

Andrez Maroto-Sanchez, ISSN: 1139-6148)

3. Growth

in services has led to higher use of services in manufacturing sector (it may

be noted that Manufacturing and Mining sectors are clubbed together as Industry

sector in calculation of GSDP). This has in turn led to higher output and

productivity growth in the manufacturing sector, which implies that the service

sector will be able to generate its own demand in the future. (2005, Banga, Critical

Issues in India’s Service Led Growth)

4. WTO

ranked India as 8th largest exporter (3.3% of world exports) and 7th largest

importer (3.1% of the world imports), in commercial services trade. Service

sector is the largest and fastest growing sector in the Indian economy making

as high as 59% contribution in total GDP of India. Services export is one of

the key thrust areas of the Government of India. Services exports have recorded

about seven fold increases in ten years from US$ 20.76 billion in 2002-2003 to

US$ 142.325 billion in 2011-2012 and US$ 105.84 billion up to December, 2013. (SEPC, Government of

India)

5. Data

on Share

and Growth of Services Sector in 2012-13 (TABLE - 2) suggest a relatively

proportionate share of all the states with a varying percentage growth for the

given year. Now, this may hold true in general, but when it comes to specific

services a pattern may be observed. For example, one such area of service is

Computer Software / Services (refer

TABLE -1 of blog post - Sharing Data on State Wise Export of Computer Software

and Services compiled by ESC). If we look at the

data in a sub-section of ‘Exported Services’ under Computer Software / Services

the data, it reveals a region wise disparity in the export of computer software

/ services is skewed in favour of South and West regions of India. The

contribution from East region has consistently been below 4% (in last three

years). Assuming the same economic legislation for exports, this disparity is

suggestive of existence of regional supremacy on production of international

quality computer software services. In this case, however, one possible

explanation could be presence of relative matured Economic Clusters in some

regions in comparison to other regions.

6. In

general, among the states taken for consideration, the surge in contribution to

GSDP from Service sector is supported with consistent incremental increase in

contribution from Industry sector. Analysis of graphs in

the blog

suggest that in the recent past, the synergic benefits of increased service

sector production on industrial production appears to be more pronounced for

developing states like Bihar (BR), Odisha (ODS) and Jharkhand (JK) and less

pronounced for relatively developed states of Andhra Pradesh (AP) and Karnataka

(KNK). One of the possible reasons for relatively less pronounced correlation

in bringing synergic benefits of increased production in services sector to

corresponding increase in industrial production could be attributed to higher

percentage of export oriented services produced by relatively developed states

like AP and Karnataka. This phenomenon could be explained through example of

ICT (Information and Communications Technology) Services (a sub-sector within

services sector also called ‘Computer Software / Services’). A

very few of the states in India have well established clusters dedicated to

export ICT Services. Many of these clusters are located within SEZs (Special

Economic Zones) and are extremely productive. Looking

into distribution of these SEZs in federal states of India, suggest that these

clusters are major contributors to share of Indian exports in the areas of

computer software services (Refer Table – 1, Table - 2 and

Table – 4 in

the link). When

production of services is calculated for the states in which these clusters are

located, a significant contribution to the calculation comes from the services

produced locally and exported abroad. Therefore, while considering a

correlation between growths in services sector vis-a-vis industrial sector of

the state under consideration, exported value of software services should be

discounted. This is not happening with the data being used for this analysis

(where Services produced are not being segregated on the basis of whether the

produce were sold for domestic use or were exported). Therefore, in such cases

it becomes important to understand that in what way the services produced in

Indian clusters are being fed back to local industries. In this regards, one

more important point to consider could be the markets of local industries.

Local industries may like to take strategic benefits of enabling services (like

(say) software services, financial services) only if they are competing in a

competitive market. Thus, it may also be useful to study the markets of the

major industrial products manufactured locally.

7. Further

observation on Comparative

GSDP of the selected states from 2004 to 2014 reveals that

for the year 2004-05, only two states have got higher contribution from

Industry sector as compared to Services sector namely Chhattisgarh (CG) and

Jharkhand (JK). Rest all the states have higher contribution of Services sector

in GSDP in comparison to contribution from Industry sector. On considering, the

structure of an economy based on comparative share of three main sectors –

agriculture, industry and services in GDP (or GSDP in

this case), it appears as if phenomenon of industrialization and post

industrialization are going-on simultaneously in Indian states. In 2004-05, CG

and JK were inclined towards Industrialization phase of the economic

development. All other states (in the sample) had already begun journey towards

Post Industrialization. In JK, Services sector produce overtook Industry

produce around year 2008-09. The same happened little late in Chhattisgarh

sometime around the year 2011-12. In comparing these two states over the given

period, JK seems to have better synergy in its industrial and services

production and it has growth much faster with steeper curves in comparison to

CG. This could be due to earlier transition of JK towards Post

Industrialization phase in comparison to CG. A deeper understanding of

industrial dynamics among these two states and comparison with other similar

states (like say Bihar (BR) and Odisha (ODS)) will be required to understand

these two states.

8. For the sake of analysis on selected sample of

states, all the values for Services sector produce are put together in one

graph in the blog-post

(Please refer Graph – 1 and Graph - 4). All the states have recorded consistent

increase in Services sector produce. Jammu & Kashmir (J&K), CG, JK,

ODS, BR and MP could be clubbed in one category (say Category A). All these

states have Service sector produce in the range of 10,000 – around 50,000 crore

INR in the year 2004-05. The other category (say Category B) could be of those

states having much more than 50,000 crore INR in the year 2004-05. Generally

speaking Category A states have doubled their produce in 2013-14 (P) from those

of their respective levels in 2004-05

and Category B states have tripled their produce during the same span of time.

If we rank all the states on the basis of production in services sector in the

year 2004-05 and again in the year 2013-14 (P), all the states will retain

their respective positions in ten years, except for Delhi (DL) and KNK. DL took

over KNK in the year 2008-09. So their respective rankings will get exchanged

in 2013-14 (P) rankings in comparison to that in the year 2004-05.

9. Service produced by ODS (falling in Category

A) in 2014-15 (P) is marginally ahead of services produced by Kerala (falling

in category B) in 2004-05. Thus, in a way ODS could be said to be running ten

year behind Kerala (KL) in terms of production of services. Similarly, values

in the year 2013-14 (P) for MP and BR are very close that of the value of AP in

2004-05. Now, from this point onwards, the growth trajectory taken by these new

states entering Category B will be interesting to look at. However, a closer

look at the journey of service sector in last ten years for KL and AP could

help ODS, MP and BR in some ways to shape future roadmap.

10. It is evident that for the states in Category

A (this includes Chhattisgarh) are consistently lagging behind in Service

sector produce from those in Category B. The same thing holds true to the

states within Category A. The states on the top are consistently consolidating

their respective positions year after year in terms of Service production. And

it appears as if this trend may continue until states on the top start

retarding (may be after reaching a threshold from where it may not be possible

to continue with same pace of growth).

11. Let us observe Industrial production patternsregistered by these states during last 10 years (Graph - 2 and Graph - 5). In this case, the picture

looks much more competitive. In this case, it may be reasonable to group those

having Industrial produce less than 35,000 crore INR in 2004-05 in Group A

(this will include MP, KL, ODS, JK, BR, CG, DL, J&K), while those more than

this value be in Group B (Gujrat (GJ), TN, AP, KNK). While Group B states are

analogues to Category B in terms of general trends of growth. However, these

states are producing less value in terms of INR as compared to their respective

produce in Services sector.

12. In 2013-14 (P) MP, KL, ODS are almost there at

the same value of production as AP and KNK were in 2004-05 in terms of

Industrial produce. JK looks to be closing towards 50,000 INR mark and BR is

catching up aggressively (one must notice that BR improved its produce by

around four times in 10 years). DL has been the only state, which looks to be

getting stagnated registering just a marginal increment to its production value in 2004-05 throughout the journey of 10

years.

13. CG was going good until 2008-09. Thereafter,

it stagnated till 2011-12. From this point onwards, it appears to be going

ahead with the same elevation as JK. Comparative assessment based on Industrial

production (for entire span of 10 years) suggests CG may not have done well.

ODS, JK and KL, were at comparable levels in earlier years have gone far ahead

during the period. BR was approximately half in value of production to CG in

2004-05 and has gone ahead in 2013-14.

14. In the graphs (Graph - 3 and Graph - 6) showing ‘Agriculture and Allied’

(to be referred to as Agriculture in this document) sector DL is at the bottom

and this is very well on expected (the state does not have significant land

available for cultivation) lines. This is followed by J&K, which has

difficult geographical terrain. Agriculture production for these two states

seems to have plateaued around constant values. AP has out-performed all other

states and is at the top. MP was going neck and neck with GJ and KNK until

2010-11 but in last three years it has registered exceptional growth. TN and BR

have been close competitors and so have CG and JK been. KL was ahead of ODS

till 2008-09 and things have reversed after that.

15. Agriculture produce may continue to increase

but its significance in GSDP is expected to keep on decreasing. However, food

security is a critical issue for India. Moreover, this is the only sector whichis still giving employment to around half the working population of India (Graph - 7).

16. Data

for Per Capita Net State Domestic Product (Per Capita) for the period 2004-05

to 2013-14 shows that CG has always been below the National Per Capita in terms

of value of Per Capita (TABLE -1). For example for the

year 2012-13, 16 States / UTs were found higher Per Capita than the National

Per Capita Value of 67839 INR and 15 States/UTs were found to have lower per

Capita than the National Per Capita. For this year amongst States / UTs, CG was

ranked at 24th position. In comparison to CG, following states were

found to have lower Per Capita ODS, MP, JK and BR, while J&K was marginally

above CG and KNK, AP, GJ, TN and DL were having higher values of Per Capita (in

reference to values for year 2012-13). The relative positions of the states

have been found to be more or less same for entire 10 years period from 2004-05

to 2013-14.

17. CG

has been in 10th position in terms of Rate of increase of Per Capita

for the year 2012-13 (TABLE - 4). And the general trend for

rate of increase in Per Capita looks to be in favour of lesser developed states

(BR, MP, ODS, J&K, CG and JK are at relatively higher positions in

comparison to KNK, AP, KL, GJ and TN).

18. It is observed that even though CG has

slightly higher Per Capita with respect to some of the closely comparable

developing states, its Industrial production and its production of Services

need to catch-up with consistent performances shown by these comparable

developing states in recent past.

B. References

1. Chapter 9: Growth of Service Sector,

Development Education program by World Bank Website - -http://www.worldbank.org/depweb/beyond/beyondco/beg_09.pdf

2. CRITICAL ISSUES IN INDIA’S SERVICE-LED

GROWTH, WORKING PAPER NO. 171, Rashmi Banga, OCTOBER 2005, INDIAN COUNCIL FOR

RESEARCH ON INTERNATIONAL ECONOMIC RELATIONS - http://www.icrier.org/pdf/WP171.pdf

3. Small Business and Entrepreneurship

Council (SBE Council) is a 501c (4) advocacy, research, training and networking

organization dedicated to protecting small business and promoting

entrepreneurship; Website - http://www.sbecouncil.org/about-us/facts-and-data/

4. SEPC, an Export Promotion Council set by

Ministry of Commerce & Industry, Government of India; Website - http://www.servicesepc.org/services-export-data/

5. Growth and Productivity in Services

Sector: The State of Art, 2010 Working Paper, Andrez Maroto-Sanchez, ISSN:

1139-6148; Website - http://www2.uah.es/iaes/publicaciones/DT_07_10.pdf

6. An evaluation of SME development in

Malaysia, 2006, Saleh and Ndubisi; Website - http://www.geasiapacifico.org/documents/IBRP1.pdf

7. Article on Forbes website, 21 MAY 2012

on work of Professor Yijiang Wang of the Cheung Kong Graduate School of

Business in Beijing; Website - http://www.forbes.com/sites/jackperkowski/2012/05/21/china-in-transition/

8.

OECD (2012), "Internationalisation

of SMEs (Dimension 10): Encourage and support SMEs to benefit from the growth

of markets (Small Business Act Principle 10)", in OECD/, SME Policy Index:

Eastern Partner Countries 2012: Progress in the Implementation of the Small

Business Act for Europe, OECD Publishing. DOI: 10.1787/9789264178847-17-en;

Website - http://www.oecd-ilibrary.org/finance-and-investment/sme-policy-index-eastern-partner-countries-2012/internationalisation-of-smes-dimension-10_9789264178847-17-en

9. Per Capita Net State Domestic Product at

Current Prices for a set of selected states given in the blog post titled:-

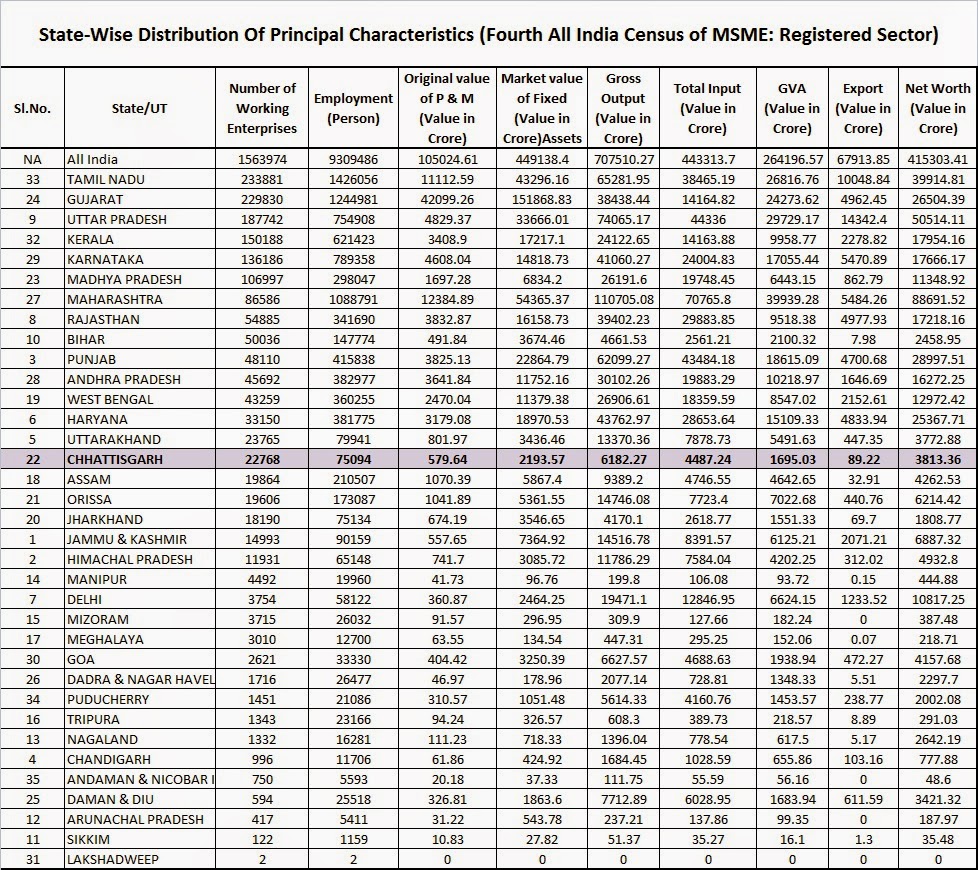

10. Place

of Chhattisgarh in All India Census of MSME: Registered Sector:-

11 State wise distribution of SEZs in India http://www.sezindia.nic.in/writereaddata/pdf/listofoperationalsezs.pdf

/**************************/